Picture this: You’re leading a critical project for the next big milestone. Everything seems to be on track, but suddenly, unexpected expenses creep in. Maybe it was a last-minute software update or an overlooked vendor fee.

Sounds familiar? You’re not alone.

A Project Management Institute (PMI) survey revealed that companies waste around 11.4% of their investments due to underwhelming project performance.

(In other words – every $1 million spent resulted in over $100,000 wasted!)

But don’t freak out already. You can easily avoid these by creating a project cost management plan. I believe that’s why you’re here in the first place.

In a nutshell, in this blog, you will discover:

- The fundamentals of project management costs

- A simple step-by-step guide to help you create your own cost management plan

- The importance of cost management

- Practical examples, challenges, mistakes, and real-world case studies you can relate to

Let’s get started with the basics right off, then.

What Is Cost Management in Project Management?

Let’s start with a proper definition. Here’s how Gartner defines cost management –

“Cost management is the process of planning and controlling the costs associated with running a business. It includes collecting, analyzing and reporting cost information to more effectively budget, forecast and monitor costs.”

I think that was pretty self-explanatory.

But here’s something I’d like to add. You need to understand that managing project costs is not just about numbers. It’s rather about setting expectations and having the discipline to stick to them.

Important Cost Management Terms:

If you plan to create your project cost management blueprint, you must be familiar with some key terms, such as –

1. Budget

Your project’s total financial plan. It’s the upper limit of how much money you’re allocating for the entire project. Every dollar you spend should fit within this budget to avoid overruns. So, it’s like your spending limit, and you want to stick to it as closely as possible.

2. Cost Baseline

A time-phased budget to measure and monitor the financial performance of the project. This is your financial benchmark to measure actual costs against and see if you’re staying on track.

3. Contingency Reserve

A safety net for unexpected but foreseeable expenses. These could include delays, minor scope changes, or price fluctuations in materials.

Here’s a smart practice: Always include a contingency reserve (5-10% of the budget) so small surprises don’t derail the whole project.

4. Cost Performance Index (CPI)

This handy project management metric measures how efficiently you’re using your budget. It tells you how much value you’re getting for every dollar spent. A CPI greater than 1.0 means you’re spending less than planned for the work completed.

5. Cost Variance (CV)

The difference between planned costs (your budget) and actual costs. It’s how you track if you’re overspending or underspending at any point in the project.

Formula: Cost Variance = Earned Value (EV) – Actual Cost (AC)

- Positive CV: You’re spending less than planned (great!).

- Negative CV: You’re overspending (not great!).

6. Scope Creep

This is the silent killer of budgets. This happens when extra features or tasks are added to the project without increasing the budget, timeline, or resources.

I’ll share an experience of how scope creep can be dangerous.

I once worked on a branding project where the client kept asking for “a few more design revisions.” By the time we finished, we’d exceeded the budget by 12%. Now, we always specify upfront how many revisions are included in contracts.

7. Direct Costs

These costs, like salaries, equipment, or materials, are directly tied to the project. These are the “must-have” expenses that drive the project forward. For example, if you’re launching a mobile app, the developer’s fee is a direct cost.

8. Indirect Costs

These costs are not directly related to the cost object and are non-traceable during the project’s life cycle. For instance, office supplies, insurance, and accounting expenses are examples of indirect costs.

9. Fixed Costs

Costs like rent, leases, taxes, and even salaries fall under fixed costs. These costs are bound to occur, no matter how many projects you have accomplished in a specific period.

10. Variable Costs

Variable costs are expenses that change based on how much you produce or sell. These are directly linked to your output. When your output increases, these costs increase. When output decreases, so do your variable costs.

For example, if your team works extra hours to finish a project, your overtime costs go up. More work = more overtime pay.

The 4 Stages of Project Cost Management:

Alright, so before we discuss how to track project costs, let’s quickly review the core processes involved. If you’re familiar with these, you can skip them and proceed directly to the steps.

Let’s walk through each of the processes in brief below.

1 Resource Planning

Resources can be anything you need to carry out project tasks and activities. These may include people, capital, equipment, and facilities to complete the project successfully. Early resource planning will prevent a resource constraint later during project execution.

If you’re looking for a complete guide on resource planning, here’s a recommended blog.

2 Cost Estimation

This is where you predict future expenses by staying within the defined scope. Compare alternatives and choose a sweet spot that minimizes cost while maintaining project quality.

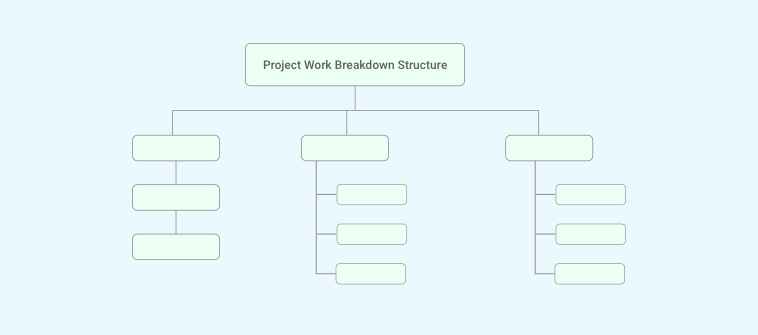

This is where a Work Breakdown Structure (WBS) comes into play. It helps you create a bottom-up estimation to ascertain the costs (fixed, variable, direct, or indirect) of project tasks and activities from initiation to completion.

Some of the most common methods for project estimation are –

- Bottom-up: Start with the smallest tasks and add up their costs to reach a total project cost. Detailed, but can be time-consuming.

- Top-down: Begin with an overall budget and allocate funds to different project phases. Quicker, but can be less accurate.

- Analogous: Use the costs of similar past projects as a benchmark. This is useful only if you have good historical data.

- Parametric: Apply formulas and calculations to estimate costs based on project variables (e.g., square footage for construction).

- Three-point: Calculate an average cost by combining three estimates—optimistic (O), most likely (M), and pessimistic (P)—using the formula E=(O+M+P)/3.

3 Budgeting

After estimating project costs, it’s time to build a budget. Setting the right budget is crucial—too low and you’ll run short of resources; too high and you risk losing approval.

Here are a few techniques that you can use to create the perfect project budget –

- Cost Aggregation: Estimate costs for each task and sum them up to form your budget baseline.

- Historical Data: Use costs from similar past projects to inform current estimates.

- Reserve Analysis: Set aside funds for unexpected costs.

- Funding Limit Reconciliation: Compare planned spending with available funds and adjust as needed.

4 Cost Control

Creating a budget is just the start. As the project unfolds, you need to monitor expenses to ensure they stay on track. If costs begin to exceed estimates, act quickly to revise your budget as needed.

Some of the useful cost control techniques include –

- Forecasting: Predict potential costs to proactively manage risks.

- Variance analysis: Compare planned and actual costs to identify deviations.

- Performance review: Regularly assess cost, schedule, and scope performance to take corrective action.

- Earned value management (EVM): Use formulas to measure project progress against planned spending.

- To-complete performance index (TCPI): A metric that helps you understand the cost performance needed to meet your budget goals.

How to Create a Cost Management Plan: A Guide to Calculate Project Costs

Creating a project cost management plan is the best way to have control over your project’s financial landscape. And the good news is that it isn’t rocket science.

So, without any further ado, let’s discuss the steps to create a working cost management plan.

Step 1: Define the Project Scope (Start With The “What”)

Before you can figure out costs, you need a crystal-clear understanding of what your project includes—and what it doesn’t. This is where you define the deliverables, timelines, resources, and scope boundaries.

For a marketing campaign, the scope might include running Google Ads, creating a landing page, and designing graphics—but NOT shooting a promotional video.

Defining the scope is easy. You need to –

- Involve stakeholders: Talk to everyone, from clients to team members to end-users, to understand their needs and expectations.

- Break it down: Divide the project into smaller, manageable tasks. This will help you identify all the activities that must be completed.

- Document everything: Create a clear and concise project scope document that outlines all the project deliverables, activities, and resources.

If you want to avoid inviting scope creep (remember that term?) to wreak havoc on your budget later, I’d recommend learning the ins and outs of creating a project scope.

Step 2: Identify & Estimate Costs (Answer The “How Much”)

Now, start listing all the costs associated with your project. Divide these into direct costs (e.g., salaries, materials) and indirect costs (e.g., office rent, utilities). Once you have the list, estimate the cost for each item as accurately as possible.

Use past project data, vendor quotes, or industry benchmarks to make your estimates realistic. But just in case you’re making wild assumptions, make sure you verify before finalizing.

📑 From the Writer’s Desk:

We had a colleague who once underestimated the cost of a custom tool for a tech project because he apparently relied on a rough guess. Such “rough guesses” are fine as long as they don’t blow the budget by $1900.

(oh, that was our project manager after he got to know about it, ha ha ha)

Step 3: Set Your Budget

Next, you need to establish the budget. I’ll try to keep this as simple as possible.

Here are some practical tips for creating your budget –

- Start with your cost estimates: Use the estimates you gathered in Step 2 as a starting point.

- Consider your project timeline: Allocate costs to specific time periods to ensure you have enough money when you need it.

- Include contingency funds: Set aside some money for unexpected costs or risks.

- Review & make adjustments: As your project progresses, adjust the budget to reflect changes in scope or other factors.

I’ll leave below a simple example of a budget for a website redesign project:

| Activity | Cost Estimate | Budget Allocation |

| Design mockups | $5,000 | $5,000 |

| Content creation | $3,000 | $3,000 |

| Development | $10,000 | $10,000 |

| Testing | $2,000 | $2,000 |

| Launch | $1,000 | $1,000 |

| Contingency | $2,000 | $2,000 |

| Total | $23,0000 | $23,0000 |

As you can see, the total budget for this project is $23,000. The budget is allocated to each activity based on the estimated cost. A contingency fund of $2,000 is also included to cover any unexpected costs.

💡 Expert Suggestion #1:

Manual budget tracking isn’t always simple, like the table above. Try imitating that for a complex project, and it’s a nightmare altogether.

But project management software like ProProfs Project can save you. Here’s how –

- Automatically generate client bills for different projects

- Automate cost estimates to ensure nothing gets overlooked

- Add external expenses beyond the initial forecast and add them to the project invoice

- Allocate costs to team members, equipment, and tasks

- Set alerts for budget overruns and adjust allocations when unexpected costs arise

- View custom dashboards or exportable reports to present budget updates to stakeholders clearly

Step 4: Develop a Monitoring & Reporting Mechanism

Without regular oversight, expenses can get out of control, and you’ll have a bloated budget and an unfinished project. To avoid this, I’ll quickly guide you through the steps necessary to develop a monitoring and reporting mechanism.

1. Choose the Right Tools:

The tools you use to monitor costs should match the complexity of your project. Here are a few options to consider:

- Use tools like Excel or Google Sheets to track costs. You can easily set up formulas for variance calculations.

- Startups or small-to-medium-sized businesses (SMBs) can use project management software like ProProfs Project for budgeting, time-tracking, and reporting features.

- Tools like QuickBooks or FreshBooks can help you manage expenses if your project involves multiple vendors or invoices.

2. Schedule Regular Check-Ins:

Decide how often you’ll review your project’s financial performance. Establish a cadence for budget reviews—weekly, bi-weekly, or monthly, depending on your project’s complexity and duration.

To set a review frequency, you need to create a recurring calendar reminder for cost reviews. During each review, compare actual costs to your cost baseline and look for any variances.

3. Assign Roles & Responsibilities:

Monitoring costs shouldn’t fall on just one person—it’s a team effort. Assign clear roles to ensure accountability.

For example, if you’re running a software development project, the development team lead could be responsible for tracking spending on tools and licenses while the project manager oversees the overall budget.

4. Create a Dashboard for Real-Time Tracking

A budget dashboard helps you visualize cost data in real time and makes it easier to spot variances. Gantt charts are a great tool for visualizing real-time progress against costs.

Watch: What Is Gantt Chart? Why Do You Need a Gantt Chart Tool for Project Management?

💡 Expert Suggestion #2:

Don’t wait until your monthly review to notice a budget issue. Set up alerts to flag cost variances as soon as they happen. How?

- In project management tools, enable notifications when spending exceeds a set threshold.

- If using Excel, create conditional formatting to highlight negative variances in red.

Step 5: Request for Stakeholder Approval

Once the project cost management plan is ready, present it to stakeholders for approval. Make sure everyone understands how costs will be monitored, controlled, and adjusted if needed.

This is important to avoid misunderstandings later. Nobody likes surprise invoices or hidden expenses, especially stakeholders who foot the bill.

But here’s the good thing: You don’t need to spend separately for separate software if you plan to use a project management platform because most of these software tools come with built-in collaboration tools.

So, whether you want to set up teams, add users, invite guests/clients, set roles and permissions, start an in-app conversation, tag using comments, or share files – you’re good to go.

(Image source: ProProfs Project)

What Are the Benefits of Managing Project Costs?

Okay, I get it. You might be thinking –

Cost management sounds like a lot of work. Is it really that important?

Trust me, it is. And I’m not just talking about the obvious stuff like avoiding budget overruns (though that’s definitely a biggie!).

So, without further ado, let’s check some of the practical benefits of cost management in project management –

1. Builds Financial Discipline

Cost management enforces a culture of financial accountability across all teams. It helps you allocate resources wisely, prioritize spending, and avoid impulsive expenditures.

In my years of experience, I’ve seen how projects with strict cost controls are less likely to encounter budget overruns or delays caused by resource shortages. So, this is a big plus, clearly.

2. Facilitates Real-Time Decision-Making

Tracking real-time costs enables swift response to budget variances or unexpected expenses. Such insights also help reallocate funds to high-priority areas to achieve critical milestones without financial bottlenecks.

3. Improves Client Relationships

Accurate project management cost tracking builds trust with clients. When investors or executives see transparent and predictable financial planning, they’re more likely to support future initiatives.

4. Minimizes Resource Wastage

Tracking project costs helps you proactively address potential risks, such as fluctuating raw material prices or unexpected labor costs. This optimization prevents waste and ensures resources contribute maximum value to the project.

5. Supports Long-Term Business Growth

Managing project costs doesn’t end with one project. Lessons you learn from managing budgets can inform future projects, making your business more efficient. Organizations with a reputation for delivering projects within budget are more likely to win contracts and client trust.

What Are the Challenges in Project Cost Management? (And How to Overcome Them)

Consistency in project management is barely a reality. You need balance, precision, and constant awareness at all times. And even then, you’ll find projects run into cost-related issues that disrupt timelines and objectives.

Let’s explore some real-world challenges you may face and actionable solutions to overcome them.

1. Misaligned Budget Priorities Across Teams

Different teams within a project often have conflicting priorities. For example, marketing may want to allocate more budget to ad campaigns, while operations need funds for logistics.

This tug-of-war can lead to overspending in some areas and neglect in others.

Wellingtone’s “The State of Project Management Report” states that only 34% of organizations are able to complete projects on budget.

How to Overcome It:

- Conduct a budget alignment workshop at the beginning of the project, where team leads and stakeholders agree on spending priorities.

- Use cost-weighted scoring models to objectively prioritize spending.

For instance, if a feature brings in 70% of the expected ROI, it should receive more funding than lower-impact activities.

- Regularly review spending priorities to adjust as the project progresses.

2. Vendor & Contractor Cost Overruns

Poorly defined contracts, hidden fees, or miscommunications often lead to exceeding vendor or contractor expenses over the agreed-upon rates. This can be detrimental to the cost management plan, and you may need to pull from contingency reserves.

How to Overcome It:

- Lock in fixed-rate contracts wherever possible to avoid cost surprises.

- Clearly define deliverables, timelines, and payment terms in the agreement.

- Build a buffer for contractor overruns into your contingency reserve (typically 10–15%).

- Use cost-tracking tools to monitor contractor invoices in real-time.

3. Overlooked “Hidden Costs”

Some costs are easy to miss during planning—things like software license renewals, additional shipping fees, or compliance-related expenses. These hidden costs can quickly eat into your budget if not accounted for.

This reminds me of a similar instance. During a logistics project, we forgot to account for increased transportation costs during the holiday season, which resulted in a 12% overspend.

How to Overcome It:

- Use checklists to account for recurring or hidden expenses (e.g., software renewals, compliance fees, training costs).

- Consult with department heads or vendors to identify potential costs you might have missed.

- Include a buffer for hidden costs in your contingency reserve.

4. Poor Risk Management Leading to Budget Shocks

Ignoring risks during the planning phase often means scrambling (and overspending) when things go wrong.

For example, in construction projects, you may even face a 20% cost spike because of unexpected weather delays that weren’t accounted for in the budget.

How to Overcome It:

- Conduct a risk assessment during the planning phase to identify potential risks and their financial impact.

- Create a Risk Register that categorizes risks by likelihood and severity.

- Allocate a portion of your contingency reserve for the highest-impact risks.

5. Communication Gaps Among Stakeholders

Miscommunication leads to duplicate spending, unapproved expenses, or misalignment in budget expectations. Many times, I’ve seen stakeholders approve additional tasks without considering their financial implications. This can hamper your budget and may lead to project failures.

How to Overcome It:

- Use collaboration platforms like ProProfs Project, Zoom, or Slack for project communication and document sharing.

- Schedule monthly budget review meetings with key stakeholders to update everyone on cost performance.

- Create a decision log to track all financial approvals and changes.

Project Cost Management: Real-World Examples & Case Studies

Theory is great, but nothing beats seeing how cost and budget management work in the real world. Here are two compelling case studies from different industries to show you the impact of effective and poor cost management practices –

Case Study 1: Effective Cost Management

NASA’s Mars Rover Project

(Image source: National Geographic)

Background: NASA’s Mars Science Laboratory (MSL), responsible for the Curiosity rover, faced significant budget overruns during development. Initial estimates pegged the project cost at $1.6 billion, but unforeseen technical challenges and scope changes caused costs to skyrocket to $2.5 billion.

Cost Management in Action:

- Identifying Risks Early: NASA employed comprehensive risk assessments to identify critical project bottlenecks, such as delays in testing advanced equipment.

- Implementing Agile Budgeting: By adopting a phased budgeting approach, they allocated additional funds for unexpected technical challenges as they arose.

- Tracking Costs in Real Time: NASA used Earned Value Management (EVM) to monitor cost performance and adjust the budget in response to variances.

Result: Despite the cost increase, NASA successfully delivered the rover to Mars in 2012. This case highlights how proactive cost management can mitigate risks and ensure the completion of high-stakes projects.

(Image source: CNN)

Case Study 2: Poor Cost Management

(Image source: Sydney Opera House)

Sydney Opera House

Background: The Sydney Opera House is an architectural marvel, but it also serves as a cautionary tale of cost mismanagement. Initially budgeted at $7 million, the final cost ballooned to $102 million over 14 years.

What Went Wrong:

- Inadequate Planning: The project’s initial scope was poorly defined, which led to frequent design changes that added costs and delayed timelines.

- No Real-Time Monitoring: Budget overruns went unchecked until it was too late.

- Inefficient Communication: Disputes between stakeholders and architects led to a lack of unified decision-making.

Result: Although the Opera House eventually became a cultural icon, its mismanagement reminds us of the importance of disciplined cost management in large-scale projects. You can read the full story – here.

(Image source: Architectural Digest)

Improve Project Profitability With a Systematically Planned Budget

At the end of the day, effective project cost management isn’t just about keeping a project on track—it’s about maximizing profitability while delivering high-quality outcomes.

So, what is a systematic approach to cost management?

Well, I think it’s a well-thought-out budget backed by consistent tracking and adjustments. And, of course, once you optimize resource allocation and avoid scope creep or unforeseen expenses, delivering projects on time and within budget becomes easier.

But here’s the thing: doing it manually just doesn’t cut it anymore. This is where project management software becomes a must-have asset. Such a tool offers features like cost-tracking dashboards, automated alerts, resource planning, collaboration, predictive analytics, and more.

But if words and theories aren’t convincing, you can try project management tools for free.

For example, ProProfs Project lets you explore the platform for free. You can sign up and start using its free plan without paying anything upfront. In my experience, that’s a great starting point, especially if you are a startup or SMB.

Learn More About Project Cost Management

What is the first step in project cost management?

The first step in project cost management is defining the scope. You need to know exactly what your project entails—all the deliverables, activities, and resources involved—before you can begin to estimate costs.

What are the 4 stages of cost management?

The 4 stages of cost management are as follows –

- Planning: Determining how you’ll estimate, budget, and control costs.

- Estimating: Predicting the cost of resources needed for the project.

- Budgeting: Allocating the estimated costs to specific activities or time periods.

- Controlling: Monitoring and managing actual costs against the budget.

How do I calculate project costs?

Calculating project costs involves a multi-step process –

- Define the scope: Determine what your project includes (and excludes). Think deliverables, timelines, and resources.

- Estimate costs: Identify all costs, both direct (salaries, materials) and indirect (rent, utilities). Use past data, vendor quotes, and industry benchmarks to make accurate predictions.

- Set your budget: Allocate your estimated costs to specific activities and time periods. Include contingency funds for unexpected expenses.

- Monitor & report: Track your spending against the budget regularly. Use project management software to stay on top of things.

- Get stakeholder approval: Present your plan to stakeholders and ensure everyone’s on the same page.

Who is responsible for cost management in a project?

While everyone on a project team plays a role in managing costs, the project manager ultimately bears the responsibility. That means they develop and execute the cost management plan and ensure the project stays within budget.

However, project managers may work with a cost estimator, financial analyst, or project accountant specializing in cost management techniques.

Which project tools help with cost management in project management?

The right tools can make cost management a breeze. Here are a few options:

- Spreadsheets: Tools like Excel or Google Sheets work well for basic cost tracking and variance calculations.

- Project management software: Platforms like ProProfs Project offer useful features for budgeting, tracking, and reporting.

- Accounting software: If you have multiple vendors or invoices, tools like QuickBooks or FreshBooks can help you manage expenses.

FREE. All Features. FOREVER!

Try our Forever FREE account with all premium features!